south san francisco sales tax rate 2021

3 The city approved a new 050 percent tax SRTU consolidating the two existing 025 percent taxes SRGF and SATG by repealing these taxes and replacing them with a new 050 percent tax. Tax Information for Tax Year 2021.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The 2018 United States Supreme Court decision in South Dakota v.

. For California residents the deadline for filing federal and state tax returns for the year 2021 is Monday April 18 2022. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. More than 100 but less than or equal to 250000.

The County sales tax rate is. Method to calculate Hollister sales tax in 2021. It was raised 0125 from 975 to 9875 in July 2021.

It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021 and raised 0125 from 85 to 8625 in July 2021. See the 2022 Tax Calendars PDF. The California sales tax rate is currently.

The minimum combined 2021 sales tax rate for Federal California is 775. What is the current sales tax rate in San Francisco CA. The County sales tax rate is 025.

In San Francisco the tax rate will rise from 85 to. How much is sales tax in San Francisco. The California sales tax rate is currently 6.

Those district tax rates range from 010 to 100. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The South San Francisco California sales tax is 750 the same as the California state sales tax.

The average sales tax rate in California is 8551. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. To order 1099 forms and other tax products call the IRS assistance center at 800 829-3676.

Presidio of Monterey Monterey 9250. 1788 rows Presidio San Francisco 8625. What is the California tax rate for 2021.

The South San Francisco sales tax rate is. Collection Procedures for Transient. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. The minimum combined 2022 sales tax rate for South San Francisco California is. Click here to find.

South San Francisco CA Sales Tax Rate. This is the total of state county and city sales tax rates. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar years 2017 to 2021 in.

Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The estimated 2022 sales tax rate for 94080 is. This is the total of state county and city sales tax rates.

The South San Francisco sales tax has been changed within the last year. The California sales tax rate is currently 6. Usually it includes rentals lodging consumer purchases sales etc.

The current Transient Occupancy Tax rate is 14. The Sales and Use tax is rising across California including in San Francisco County. This is the total of state county and city sales tax rates.

What is the sales tax rate in South San Francisco California. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. The County sales tax rate is 025.

Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. Therefore there is no change to the tax rate. The Sales tax rates may differ depending on the type of purchase.

The San Francisco Tourism Improvement District sales tax has been changed within the last year. The average sales tax rate in California is 8551. Has impacted many state nexus laws and sales tax collection requirements.

The current Conference Center Tax is 250 per room night. The South San Francisco Sales Tax is collected by the merchant on all qualifying sales. The County sales tax rate is 025.

Did South Dakota v. San Francisco California sales tax rate details The minimum combined 2021 sales tax rate for San Francisco California is 863. To review these changes visit our state-by-state guide.

The California sales tax rate is currently 6. This is the total of state county and city sales tax rates. San Francisco Public Library does NOT carry 1099 forms.

The minimum combined sales tax rate for San Francisco California is 85. 250 for each 500 or portion thereof. Tax returns are required monthly for all hotels and motels operating in the city.

Transfer Tax In San Mateo County California Who Pays What

California Sales Tax Small Business Guide Truic

California Sales Tax Rates By City County 2022

California City County Sales Use Tax Rates

Chicago Il Cost Of Living Is Chicago Affordable Data

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

States With Highest And Lowest Sales Tax Rates

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

I Overview In Tax Harmonization In The European Community

Finance Department City Of South San Francisco

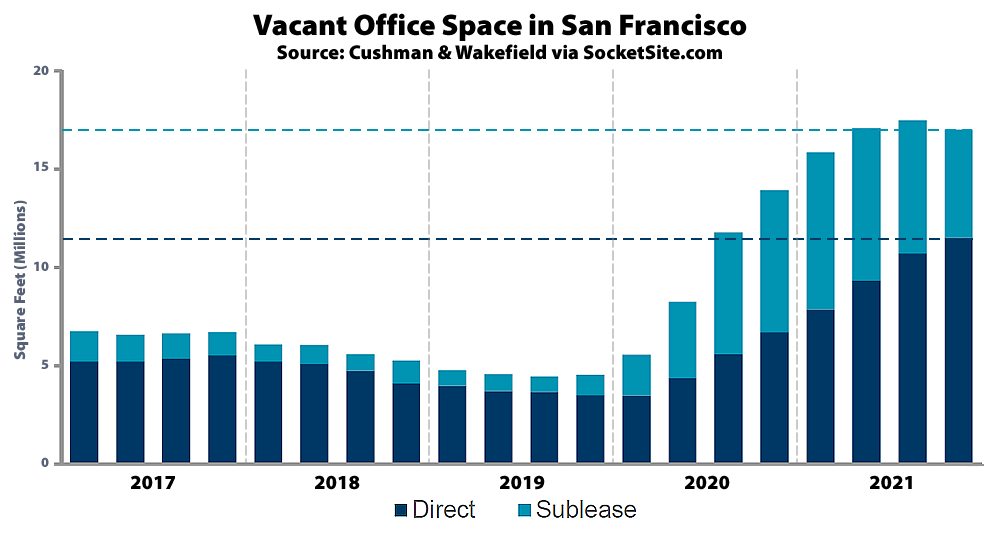

Office Vacancy Rate In San Francisco Inches Down But

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax On Saas A Checklist State By State Guide For Startups

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

Sales Tax By State Is Saas Taxable Taxjar

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop